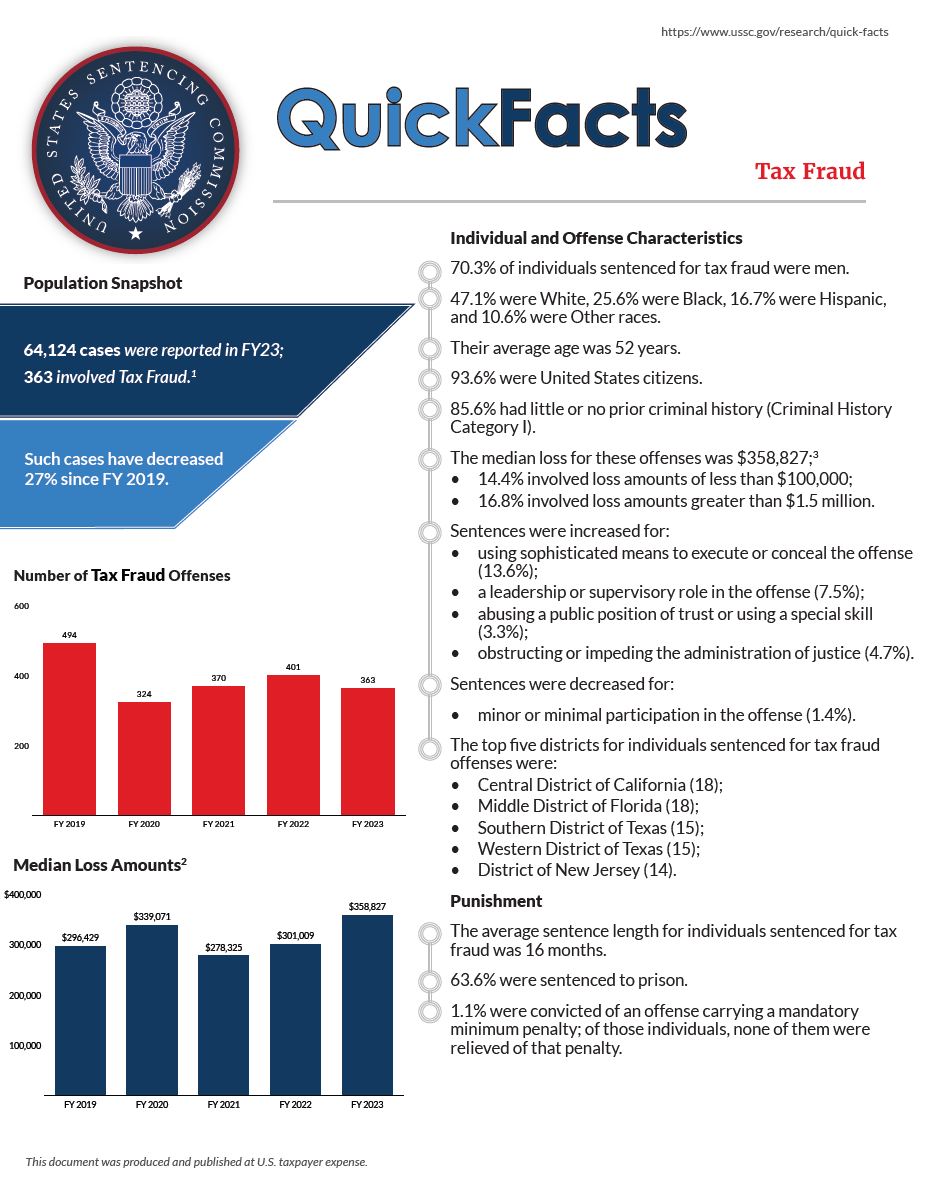

Of the 61,678 cases reported to the Commission in fiscal year 2024, 360 involved tax fraud (up 11.0% since fiscal year 2020).1,2

Click the cover for the PDF handout or learn more below.

Individual and Offense Characteristics

- 76.4% of individuals sentenced for tax fraud were men.

- 51.5% were White, 25.9% were Black, 11.3% were Hispanic, and 11.3% were Other races.

- Their average age was 54 years.

- 93.8% were United States citizens.

- 86.8% had little or no prior criminal history (Criminal History Category I).

- The median loss for these offenses was $491,302;3

- 9.0% involved loss amounts of less than $100,000;

- 20.5% involved loss amounts greater than $1.5 million.

- Sentences were increased for:

- using sophisticated means to execute or conceal the offense (16.9%);

- a leadership or supervisory role in the offense (6.5%);

- abusing a public position of trust or using a special skill (3.7%);

- obstructing or impeding the administration of justice (6.5%).

- Sentences were decreased for:

- minor or minimal participation in the offense (1.1%).

- minor or minimal participation in the offense (1.1%).

- The top five districts for tax fraud offenses were:

- District of Massachusetts (20);

- Northern District of Ohio (17);

- Eastern District of New York (16);

- Middle District of Florida (16);

- Central District of California (15).

Punishment

- The average sentence length for individuals sentenced for tax fraud was 15 months.

- 66.0% were sentenced to prison.

- No individuals were convicted of an offense carrying a mandatory minimum penalty.

Sentences Relative to the Guideline Range

- 45.2% of sentences for tax fraud were under the Guidelines Manual.

- 28.9% were within the guideline range.

- 12.4% were substantial assistance departures.

- The average sentence reduction was 79.9%.

- The average sentence reduction was 79.9%.

- 3.7% were some other downward departure.

- The average sentence reduction was 69.5%.

- The average sentence reduction was 69.5%.

- 28.9% were within the guideline range.

- 54.8% of sentences for tax fraud were variances.

- 54.5% were downward variances.

- The average sentence reduction was 64.4%.

- The average sentence reduction was 64.4%.

- 0.3% were upward variances.4

- 54.5% were downward variances.

- The average guideline minimum increased and average sentence imposed have remained steady over the past five years.

- The average guideline minimum was 26 months in fiscal year 2020 and 25 months in fiscal year 2024.

- The average sentence imposed was 16 months in fiscal year 2020 and 15 months in fiscal year 2024.

- The average guideline minimum was 26 months in fiscal year 2020 and 25 months in fiscal year 2024.

1 Tax fraud offenses include cases in which the individual was sentenced under §2T1.1 or §2T1.4 (Tax Evasion; Willful Failure to File Return, Supply Information, or Pay Tax; Fraudulent or False Returns, Statements, or Other Documents or Aiding, Assisting, Procuring, Counseling, or Advising Tax Fraud).

2 Cases with incomplete sentencing information were excluded from the analysis.

3 The Loss Table was amended effective November 1, 2001 and November 1, 2015.

4 The Commission does not report the average for categories with fewer than three cases.

SOURCE: United States Sentencing Commission, FY 2020 through FY 2024 Datafiles, USSCFY20-USSCFY24.