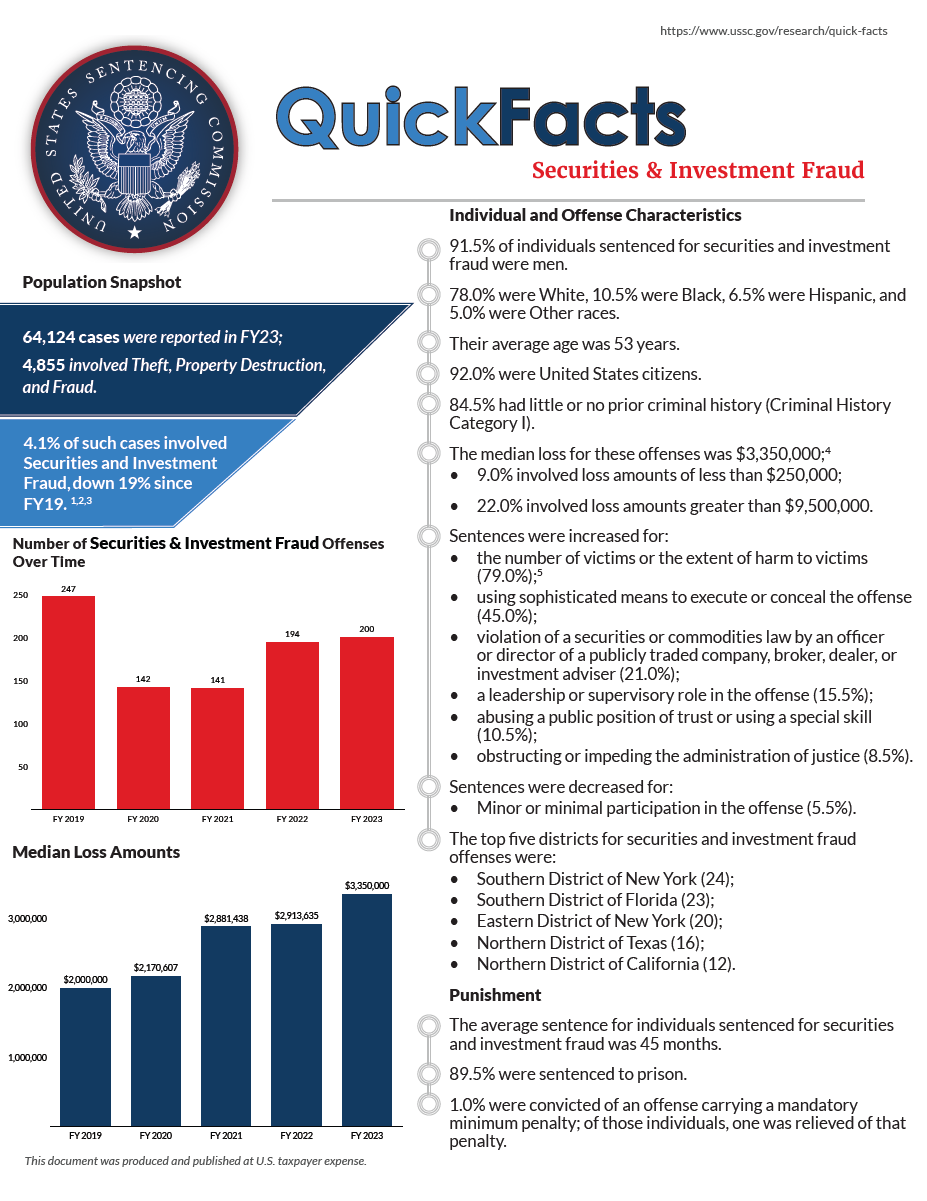

Of the 61,678 cases reported to the Commission in fiscal year 2024, 178 involved securities and investment fraud.1,2 Securities and investment fraud offenses have increased 25.4% since fiscal year 2020.

Click the cover for the PDF handout or learn more below.

Individual and Offense Characteristics

- 93.3% of individuals sentenced for securities and investment fraud were men.

- 76.2% were White, 8.5% were Black, 8.5% were Hispanic, and 6.8% were Other races.

- Their average age was 51 years.

- 87.6% were United States citizens.

- 90.4% had little or no prior criminal history (Criminal History Category I).

- The median loss for these offenses was $1,949,537;3

- 9.0% involved loss amounts of less than $250,000;

- 20.2% involved loss amounts greater than $9,500,000.

- Sentences were increased for:

- the number of victims or the extent of harm to victims (74.2%);4

- using sophisticated means to execute or conceal the offense (37.1%);

- violation of a securities or commodities law by an officer or director of a publicly traded company, broker, dealer, or investment adviser (18.0%);

- a leadership or supervisory role in the offense (13.4%);

- abusing a public position of trust or using a special skill (11.8%);

- obstructing or impeding the administration of justice (9.0%).

- Sentences were decreased for:

- minor or minimal participation in the offense (9.6%).

- minor or minimal participation in the offense (9.6%).

- The top five districts for securities and investment fraud offenses were:

- Southern District of New York (25);

- Eastern District of New York (15);

- District of Massachusetts (11);

- Central District of California (10);

- Southern District of Florida (10).

Punishment

- The average sentence for individuals sentenced for securities and investment fraud was 38 months.

- 88.2% were sentenced to prison.

- None were convicted of an offense carrying a mandatory minimum penalty.

Sentences Relative to the Guideline Range

- 54.5% of sentences for securities and investment fraud were under the Guidelines Manual.

- 25.8% were within the guideline range.

- 21.3% were substantial assistance departures.

- The average sentence reduction was 77.0%.

- The average sentence reduction was 77.0%.

- 7.3% were some other downward departure.

- The average sentence reduction was 61.7%.

- The average sentence reduction was 61.7%.

- 25.8% were within the guideline range.

- 45.5% of sentences for securities and investment fraud were variances.

- 42.1% were downward variances.

- The average sentence reduction was 52.6%.

- The average sentence reduction was 52.6%.

- 3.4% were upward variances.

- The average sentence increase was 93.2%.

- 42.1% were downward variances.

- The average guideline minimum fluctuated and average sentence imposed slightly decreased over the past five years.

- The average guideline minimum increased and decreased throughout the fiscal years. The average guideline minimum was 66 months in fiscal year 2020 and 61 months in fiscal year 2024.

- The average sentence imposed decreased from 46 months in fiscal year 2020 to 38 months in fiscal year 2024.

- The average guideline minimum increased and decreased throughout the fiscal years. The average guideline minimum was 66 months in fiscal year 2020 and 61 months in fiscal year 2024.

1 Securities and investment fraud includes cases in which the individual was sentenced under §2B1.1 (Larceny, Embezzlement, and Other Forms of Theft; Offenses Involving Stolen Property; Property Damage or Destruction; Fraud and Deceit; Forgery; Offenses Involving Altered or Counterfeit Instruments Other than Counterfeit Bearer Obligations of the United States) using a Guidelines Manual in effect on November 1, 2001 or later and where the offense conduct as described in the Presentence Report involved the deception of investors or the manipulation of financial markets.

2 Cases with incomplete sentencing information were excluded from the analysis.

3 The Loss Table was amended effective November 1, 2001 and November 1, 2015.

4 The Victims Table and Sophisticated Means adjustment were amended effective November 1, 2015.

SOURCE: United States Sentencing Commission, FY 2020 through FY 2024 Datafiles, USSCFY20-USSCFY24.